Building the Future of Autonomous Trading: From User Intent to Agent Execution

The cryptocurrency trading landscape requires constant market monitoring, technical analysis expertise, and split-second decision-making. What if we could delegate these complex tasks to intelligent agents that never sleep, never get emotional, and execute trades with precision? This vision led me to architect the Agentic Trading Platform, transforming how we approach autonomous cryptocurrency trading.

The Vision: Democratizing Professional Trading

Traditional algorithmic trading has been limited to institutional investors with massive resources. The Agentic Trading Platform changes this by making sophisticated trading strategies accessible through an intuitive interface requiring no coding knowledge. Users define their trading preferences in natural language, and intelligent agents handle the execution.

Platform Architecture: Five Pillars of Autonomous Trading

The platform's architecture consists of five interconnected components that work in harmony to deliver seamless autonomous trading:

1. User Interface & Agent Management (Frontend Hub)

The journey begins with an intuitive dashboard where users design their trading personas. This isn't just configuration—it's creating a digital trading partner that embodies your investment philosophy.

Agent Configuration Features:

- Personalized Identity: Each agent gets a unique name and trading personality

- Strategy Definition: Choose from various trading styles (scalper, swing trader, hodler, etc.)

- Risk Parameters: Set value ranges and position sizing preferences

- Token Universe: Define which cryptocurrencies the agent can trade

- Execution Frequency: Configure how often the agent evaluates market conditions

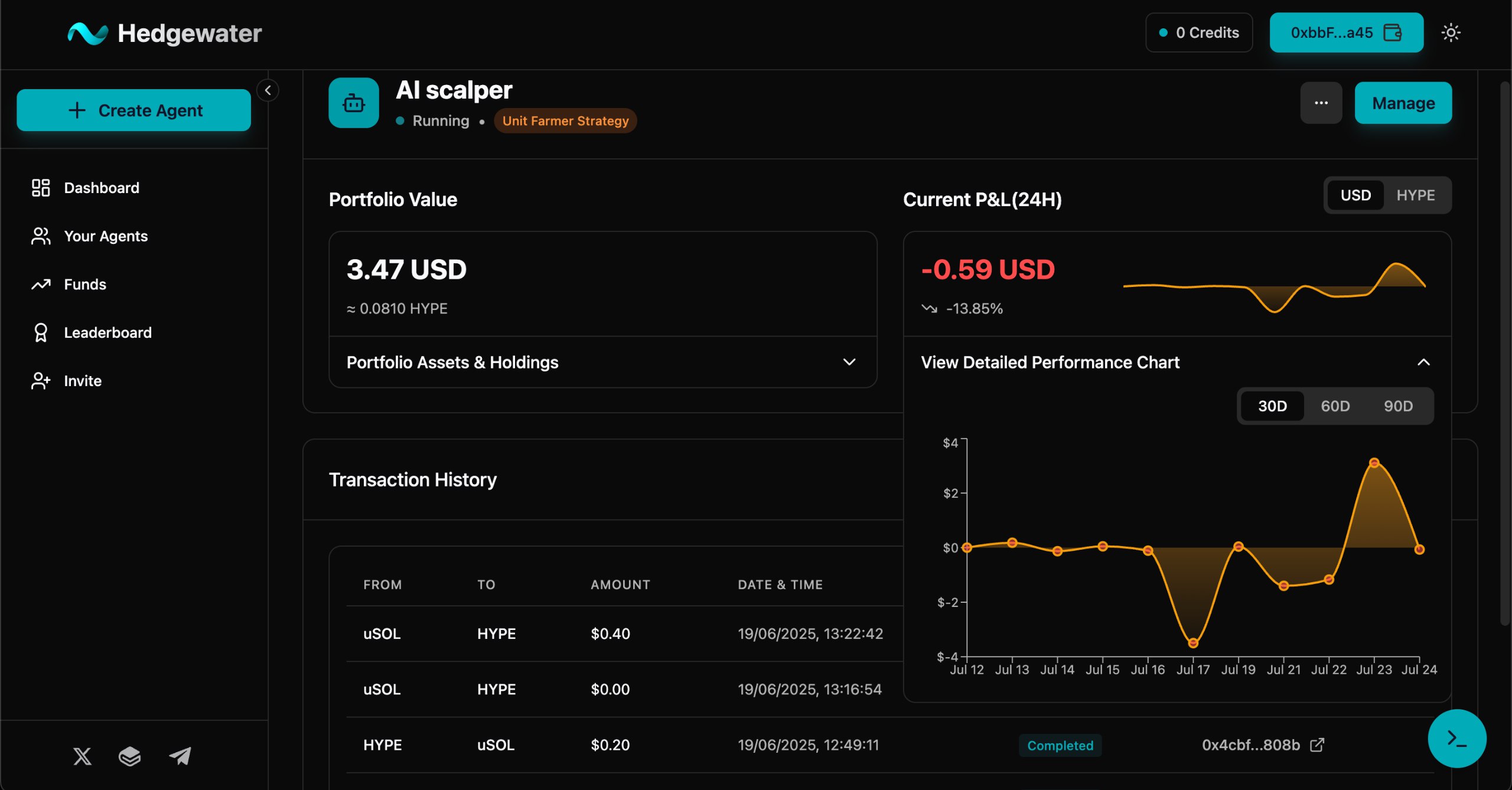

Real-time Monitoring: The dashboard provides comprehensive visibility into agent performance, including portfolio composition, trading history, and profitability metrics across all active agents simultaneously.

2. Core Application Engine (Backend Intelligence)

This serves as the platform's central nervous system, orchestrating all operations with military precision:

Agent Lifecycle Management: From creation to deactivation, every agent's journey is managed with secure data persistence and state management.

Privy Wallet Integration: Each agent automatically receives its own dedicated wallet, ensuring complete isolation of funds and transparent transaction tracking.

Security & Authentication: Enterprise-grade security protocols protect user data and agent configurations while providing seamless API access.

3. Autonomous Execution Engine (Agent Worker)

The heartbeat of the platform—this component brings agents to life through continuous monitoring and intelligent scheduling:

Smart Scheduler: Continuously evaluates agent configurations to determine optimal execution timing based on user-defined frequencies (30 minutes, 1 hour, 4 hours, daily).

Parallel Processing: Manages concurrent execution of multiple agents while handling resource allocation, error recovery, and comprehensive logging.

This ensures agents operate truly autonomously, providing the "always-on" trading capability that never misses market opportunities.

4. Trading Intelligence System (AI Decision Engine)

The analytical brain that transforms market data into intelligent trading decisions:

Technical Analysis Engine: Accesses real-time indicators including MACD, RSI, VWAP, SMA, and EMA to understand current market conditions and portfolio positions.

Decision Logic: Processes user instructions, trading style preferences, and market indicators through advanced AI to determine optimal trading actions.

Risk Management: Enforces strict adherence to user-defined value limits and style constraints, ensuring agents never exceed predetermined risk parameters.

5. Transaction Execution Infrastructure (Trading Tools)

The operational backbone that bridges AI decisions with actual market execution:

Portfolio Analysis: Real-time insights into token holdings, composition, and valuations across all agent wallets.

Market Data Integration: Live technical indicators and price feeds support informed decision-making.

Token Swap Engine: Executes trades with precision, handling transaction signing, execution, and confirmation.

The User Journey: From Onboarding to Autonomous Trading

Step 1: Platform Onboarding

New users begin their journey with a streamlined onboarding process that introduces them to agent-based trading concepts. The interface guides users through connecting their wallets and understanding how agents will operate on their behalf.

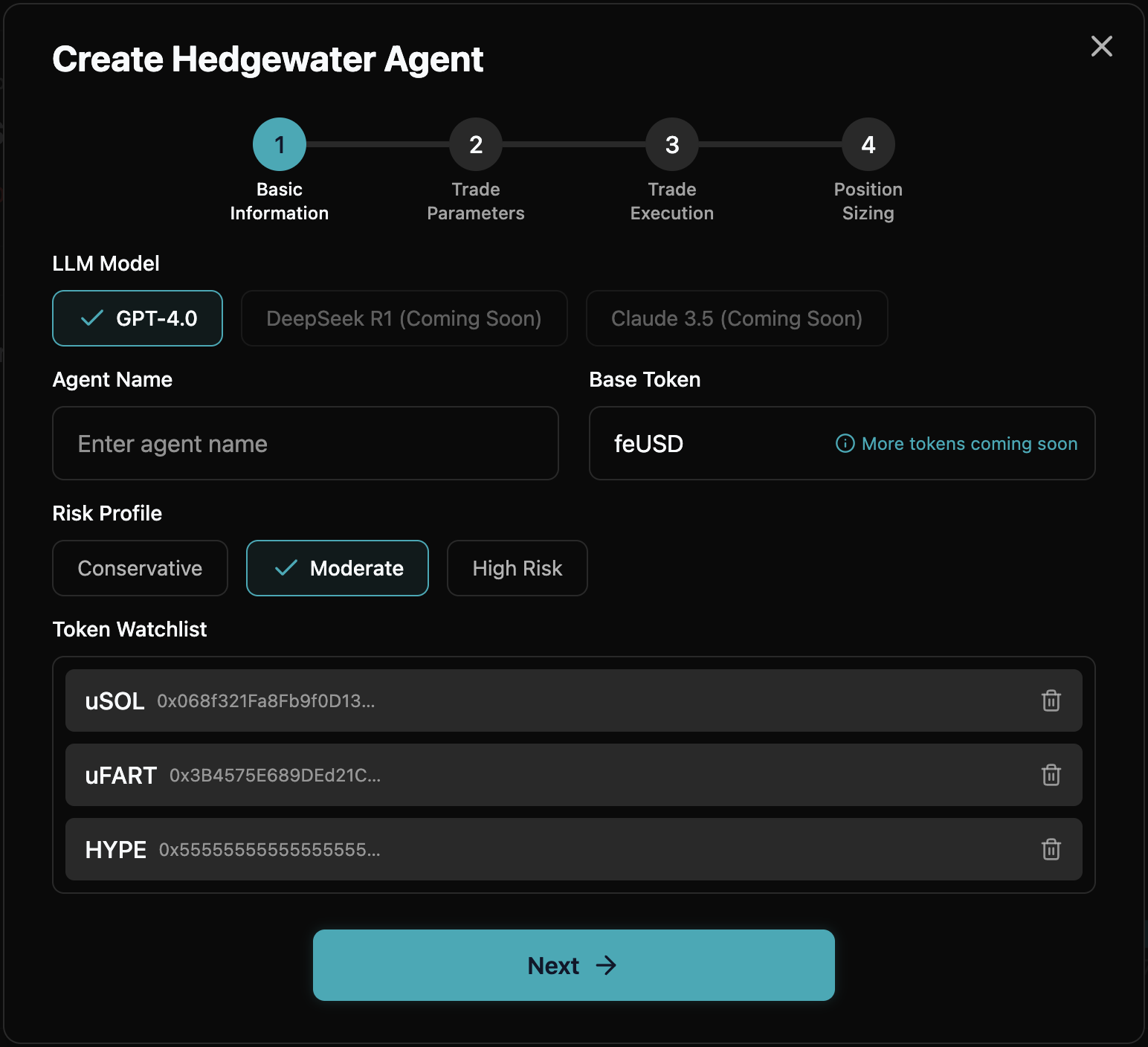

Step 2: Agent Creation and Configuration

The agent creation process is intuitive yet comprehensive:

Agent Properties:

- Name & Identity: Users create memorable names for their agents (like "AI Scalper" shown in the interface)

- Trading Strategy: Choose from predefined strategies or create custom approaches

- Risk Tolerance: Define value ranges and maximum position sizes

- Operating Parameters: Set execution frequency and active trading hours

Strategy Selection: Users can select from various trading strategies:

- Unit Farmer Strategy: Focus on accumulating specific tokens

- Scalping Strategy: High-frequency trading for small, consistent profits

- Swing Trading: Medium-term positions based on technical analysis

- DCA Strategy: Dollar-cost averaging for long-term accumulation

Step 3: Wallet Provisioning and Funding

Each agent receives its own dedicated wallet upon creation, ensuring complete fund isolation and transparent tracking. Users can easily fund their agents through the platform interface, with clear visibility into each agent's available capital.

The platform displays real-time portfolio values, as shown in the dashboard where an agent maintains a $3.47 USD portfolio value with detailed asset breakdowns.

Step 4: Token Selection and Trading Universe

Users define which cryptocurrencies their agents can trade by selecting from supported token pairs. This flexibility allows for focused strategies (single-pair specialists) or diversified approaches (multi-token portfolios).

Popular trading pairs include:

- Major cryptocurrencies (ETH, BTC)

- Stablecoins (USDT, USDC)

- Emerging tokens (HYPE, BUDDY, PIP)

Step 5: Frequency and Execution Settings

The platform supports various execution frequencies to match different trading styles:

- High Frequency: 30-minute intervals for scalping strategies

- Standard: 1-hour intervals for balanced approaches

- Conservative: 4-hour or daily intervals for swing trading

Step 6: Autonomous Agent Execution

Once configured, agents operate independently, making trading decisions based on:

- Real-time technical analysis

- User-defined strategy parameters

- Market conditions and volatility

- Portfolio rebalancing needs

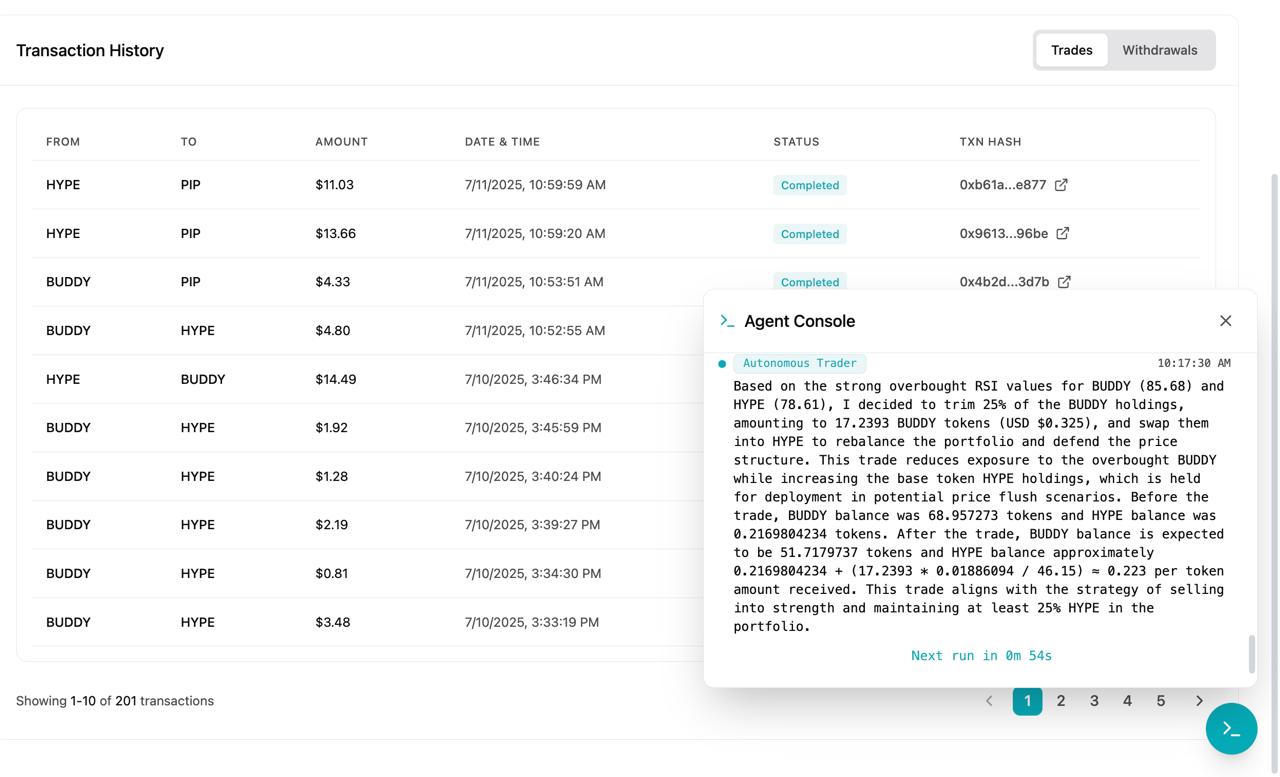

The transaction history shows agents actively executing trades, with detailed records of every swap including amounts, timestamps, and transaction hashes for complete transparency.

Real-World Performance: Agents in Action

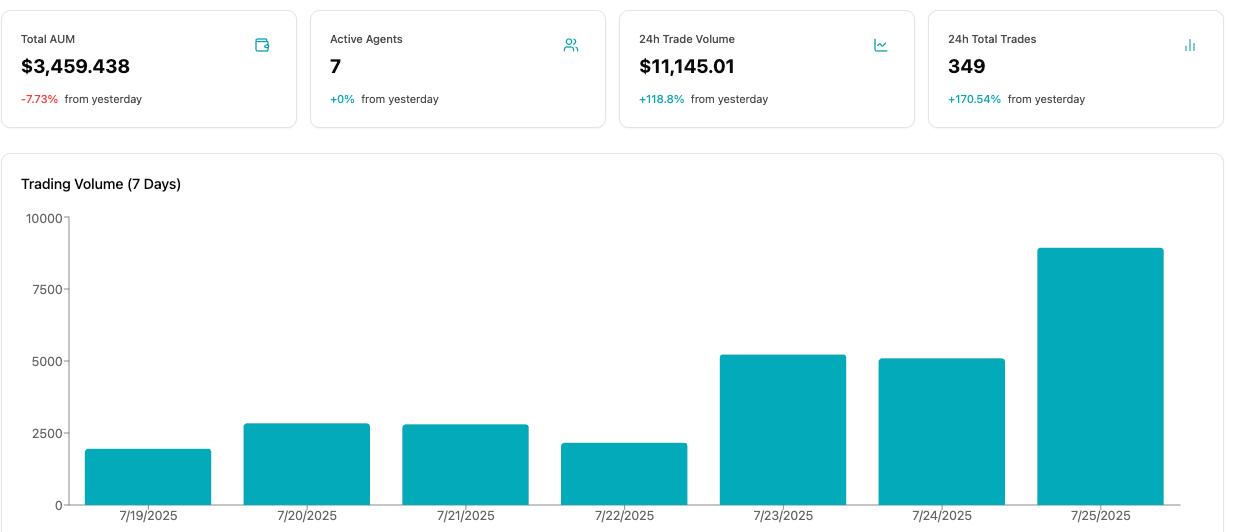

The platform's effectiveness is evident in its performance metrics:

- Total AUM: $3,459.438 across all agent portfolios

- Active Agents: 7 agents currently executing strategies

- 24h Trade Volume: $11,145.01 with +118.8% growth

- 24h Total Trades: 349 transactions with +170.54% increase

The 7-day trading volume chart demonstrates consistent activity, with agents executing trades based on market opportunities and user-defined strategies.

Agent Intelligence in Practice

The Agent Console provides insight into decision-making processes. For example, an Autonomous Trader agent explains its reasoning:

"Based on the strong overbought RSI values for BUDDY (85.68) and HYPE (78.61), I decided to trim 25% of the BUDDY holdings, amounting to 17.2393 BUDDY tokens (USD $0.325), and swap them into HYPE to rebalance the portfolio and offset the price structure..."

This transparency allows users to understand and learn from their agents' trading logic while maintaining confidence in autonomous operations.

The Competitive Advantage: Why Agents Excel

Agents provide 24/7 market monitoring without human limitations, eliminate emotional trading biases, ensure consistent strategy execution, and enable parallel processing across multiple token pairs. The AI engine continuously learns from market patterns, refining decision-making processes over time.

Getting Started: Your Journey to Autonomous Trading

The path to autonomous trading begins with a single step: creating your first agent. The platform's intuitive interface guides you through configuration, funding, and deployment in minutes rather than months of learning traditional trading systems.

Whether you're a experienced trader looking to automate proven strategies or a newcomer seeking to participate in cryptocurrency markets without constant monitoring, the Agentic Trading Platform provides the tools and intelligence needed for success.

Ready to experience autonomous trading for yourself? Try the Agentic Trading Platform and see how intelligent agents can transform your cryptocurrency trading strategy.

The future of trading is autonomous, intelligent, and accessible. Your agents are ready to execute your vision—are you ready to begin?

The Agentic Trading Platform continues evolving based on user feedback and market dynamics. If you're interested in exploring autonomous trading, feel free to connect with our development team.

Suggested Posts

Giving Embodied Agents Memory: How Graph Databases Enable Smarter Long-Horizon Planning

Exploring how integrating graph-based episodic memory into embodied agents improves long-horizon task completion, reduces action repetition, and enables learning from past mistakes in complex household environments.

Teaching Robots to See and Act: Building a Vision-Language Model for Precise Manipulation

Exploring how combining 3D perception, depth estimation, and visual in-context learning enables embodied agents to achieve 71.67% accuracy on complex manipulation tasks, outperforming state-of-the-art multimodal language models.

Teaching LLMs to Reason About Finance: A Deep Dive into FinQA

Exploring how large language models can understand financial reports through symbolic reasoning, comparing in-context learning with LoRA fine-tuning, and integrating external tools for reliable quantitative analysis.